Trump’s Tariff Escalation Brings Domestic Costs Without Strategic Clarity

The White House launched an aggressive tariff campaign with the stated goal of correcting trade imbalances with China. By April, average tariffs on Chinese goods reached 20 percent, surging to 124 percent by May. Some Chinese products face tariffs as high as 245 percent starting in 2025, creating significant cost burdens for importers. “We’ve already raised tariffs to such a high degree that with time, trade will go to zero,” one source warned. Businesses now navigate an uncertain climate with little predictability, while operational costs for American firms continue climbing.

Debt Vulnerabilities Offer Beijing Quiet Influence Over Washington

China holds U.S. Treasury securities amounting to roughly 4 percent of the American GDP, offering it quiet but potent leverage. Treasury bond yields surged in April as tariff headlines spread, pushing mortgage rates higher across the country. Analysts speculated that foreign entities were dumping bonds, prompting fears of intentional sabotage in financial markets. One expert noted, “China may not even have to fire that gun… people assume that it’s China and then further imperil the U.S. situation.” While Beijing has not made any overt financial moves, the potential alone has rattled confidence in U.S. financial stability.

Rare Earth Supply Chains Expose Strategic Weakness

Beijing controls about 60 percent of the global supply of rare earth elements used in defense, clean energy, and manufacturing. Gallium, germanium, and antimony are already under Chinese export controls, signaling the beginning of a broader clampdown. U.S. dependency on these imports leaves major sectors exposed, with defense analysts warning that sourcing alternatives will require years of investment. A policy researcher emphasized, “The U.S. is extremely vulnerable” in this space, highlighting how deeply embedded Chinese supply chains remain. For now, no rapid solution appears feasible, especially as global competition for these materials intensifies.

Trade Shifts Disrupt Port Operations and Storage Systems

Tariff impacts have slowed down shipping activity at U.S. ports, creating a ripple effect across national supply systems. Importers report rising storage costs while postponing deliveries, hoping the economic standoff resolves. Businesses are now rerouting supply lines through Southeast Asia and Europe, although tariff regimes in those regions remain uncertain. Companies are betting that anything outside of China offers fewer trade disruptions, at least temporarily. The increased burden on customs infrastructure reflects a broader institutional fatigue with prolonged trade war logistics.

China Deploys Strategic Pressure Against U.S. Corporations

Beijing has instructed state-run energy and airline firms to freeze purchases of U.S. goods, including natural gas and Boeing aircraft. Chinese regulators have also updated their “unreliable entity list,” which adds barriers for American firms attempting to operate locally. The move signals broader restrictions against companies such as Tesla, which relies on Chinese parts and market access. Analysts caution that these retaliatory tactics are incremental, allowing Beijing to adjust pressure without triggering immediate collapse. “If China really wanted to play nasty… they could squeeze Tesla” and others, one observer noted.

Agriculture and Red States Face Another Blow

Soybean farmers, especially those in Midwestern states, face renewed anxiety over the future of their exports to China. During the 2018 trade war, farmers lost market share to competitors in Brazil, which took years to rebuild. Farmers now fear a repeat as China targets agricultural imports from the United States. “Many of our soybean farmers… trying to rebuild relationships… likely going to be hit again,” one industry expert observed. These rural economies, which often form the electoral base of U.S. trade hawks, are absorbing the long-term impact of Washington’s short-term policy choices.

Global Sentiment Drifts Away from Washington’s Influence

The recent tariff escalation is driving foreign governments to reevaluate long-standing economic relationships with the United States. Concerns have grown that the European Union may align more closely with Beijing to avoid collateral damage from U.S. trade actions. One expert stated, “The reason the dollar persists… is not because of any real fondness or American soft power.” The American trade posture has strained relationships that once operated on goodwill and cooperation. Instead of asserting strength, the tariff campaign has exposed a lack of reliable strategic partnerships.

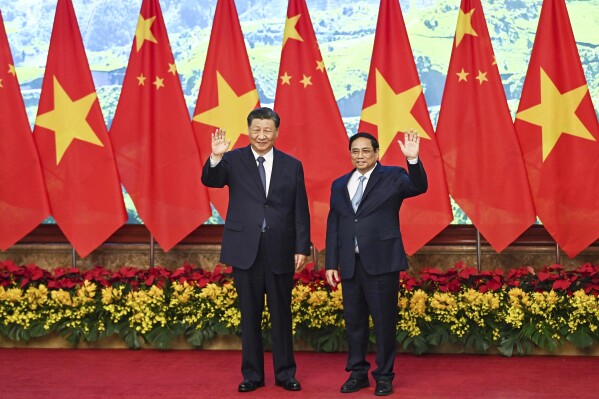

Soft Power Diminishes as Beijing Gains Momentum

President Xi Jinping visited Vietnam, Cambodia, and Malaysia shortly after tariffs were announced, encouraging regional cooperation against Washington. He framed the trade war as unilateral bullying, calling for collective resistance from neighboring states. China followed through by delaying purchases of U.S. energy and aerospace products, signaling that its options extend beyond economic passivity. Nations that side with Washington may face retaliatory restrictions on trade, aviation, and investment inside China. This slow but strategic diplomacy reinforces China’s long-term plan to reshape its alliances and trade flows.

Manufacturing Base Continues to Wither in America

Many U.S. firms have relied on low-cost Chinese manufacturing for decades, benefitting from cheap labor and weak environmental regulations. American consumers supported this trend, drawn by affordable prices that domestic production could not match. One policy analyst remarked, “Apple would not be as profitable if it was not able to make all its iPhones in China.” Now, companies are caught between political pressure to reshore and logistical limitations preventing them from doing so. The result is a trade war with few winners and growing fractures in the U.S. economic structure.

Administrative Capacity Falls Short of Policy Ambition

Customs and Border Protection has been tasked with managing the bureaucratic weight of the tariff war without adequate staffing or infrastructure. Long delays, port congestion, and administrative backlogs reflect the operational burden being placed on frontline agencies. A logistics official posed the question, “Can it be achieved with the current set of resources and manpower?” The answer remains doubtful, given the pace and scope of new directives. Without structural investment in enforcement and oversight, the U.S. government is creating policy faster than it can manage its consequences.